Become an On-Chain Savant 001 - Fundamentals

Sick & tired of being bullish at tops & bearish at bottoms? Do you day-dream "what if" scenarios where you buy troughs and sell the pico top? I got you covered (even if you're "SHIB to $1" special).

This is part three of my On-Chain Masterclass series. You can find the other parts here:

On-chain fundamentals - This article

What is on-chain analysis?

Put simply, this involves analysing data found publicly on the blockchain, rather than price action or other data that isn’t found on-chain. The idea is that since all transactions (TX’s) are public, irreversible, and have a cost attached to them, making spoofing misleading TX’s an unprofitable strategy. This inherent cost makes these data points more legit than say an orderblock on an exchange that can be moved/cancelled with no effort/expense.

How is it compiled?

At a high level, on-chain metrics are put together using different combinations of basic building blocks such as:

Sending/Receiving addresses and the entities behind them

Coin/token balances

Amount sent/received

Transaction counts & type (outgoing vs incoming)

Miner/validator rewards, fees etc

Time

The Building Blocks

Market Cap

Probably one of the most abused terms on YouTube (after “fractal”). This is simply the total value of the entire network. The calculation is crazy simple:

Market Cap = Total Supply x Market PriceWhat’s its purpose? Well we use Mcap as a baseline to compare asset sizes (my shitcoin is twice as big as yours), build adoption and valuation models, liquid supply profiles etc.

YouTube shillers love Market Cap as a metric, because most retail traders don’t understand it, e.g: Muh XRP to $589 would give it a Mcap (at max supply) of $58,900,000,000,000 vs a Global GDP of $90,000,000,000,000. The chances of that happening are on par with Craig Wright being Satoshi.

Entity Metrics

The term entity in On-Chain analysis refers to an individual, company, institution, DAO etc’s addresses on a network. On-chain analysis companies use clustering algos to guestimate that for example, all the BTC addresses your Trezor generates belong to the same entity (you). These clusters are generally filtered to exclude inter-entity TXs (e.g: an exchange moving funds from a cold wallet to a hot wallet).

This is an imperfect process, nonetheless, it can provide us with some valuable colour into what’s happening within the network, its utilisation, and it’s participant’s behaviour.

On chain analysis provides a glimpse into the key market drivers: fear and greed.

Key Entity Metrics

New entities: This is simply the number of new unique entities that have appeared on the network with a specific timeframe (e.g: new entities in the last 10/30/60 days). It provides us with a super high level idea as to whether more users are getting attracted to the network or not, as well as its rate of change (it tends to steepen in bullish phases as retail piles in, and tapers off after the peak). Look out for a divergence with price (price increases as metric declines) as a leading signal that buyers are getting exhausted and vice versa.

Entity Net Growth: This is simply the number of new entities, less the ones that have disappeared (i.e. who’s balance went from >0 to 0).

Number of Active Entities: This one is simple. It’s the number of unique entities that have sent or received a TX within a certain timeframe.

Number of Sending Entities: Again, it’s what it says on the can. The number of entities that have sent BTC within a certain timeframe.

Number of Receiving Entities: As the above, but these entities received BTC.

Whale Count: Number of entities with >1000BTC balance. Increasing whale count is a sign of accumulation by smart money, decreasing whale count is a sign of distribution. Many On-chain analytics platforms also cluster addresses with lower thresholds (Dolphins, Sharks, Shrimps etc), and provide stacked charts such as the Hodl Wave. This provides insight into market conviction, as accounts get promoted up or down the ranks. It’s also a very nuanced metric as it can show who is accumulating and who’s selling. Are shrimps buying while whales distribute? Are shrimps capitulating into whale’s bids? You get the picture.

Hodl Waves

Buyers bidding an asset up is great, but what’s greater still? That bid not coming from paper-handed chronic vacillators who flip bias with every 1H candle. Greatererest of all, is if that bid is being laid down by long term, diamond-handed investors who lock away that supply for long periods of time, reducing the supply available for new gamblers investors to buy.

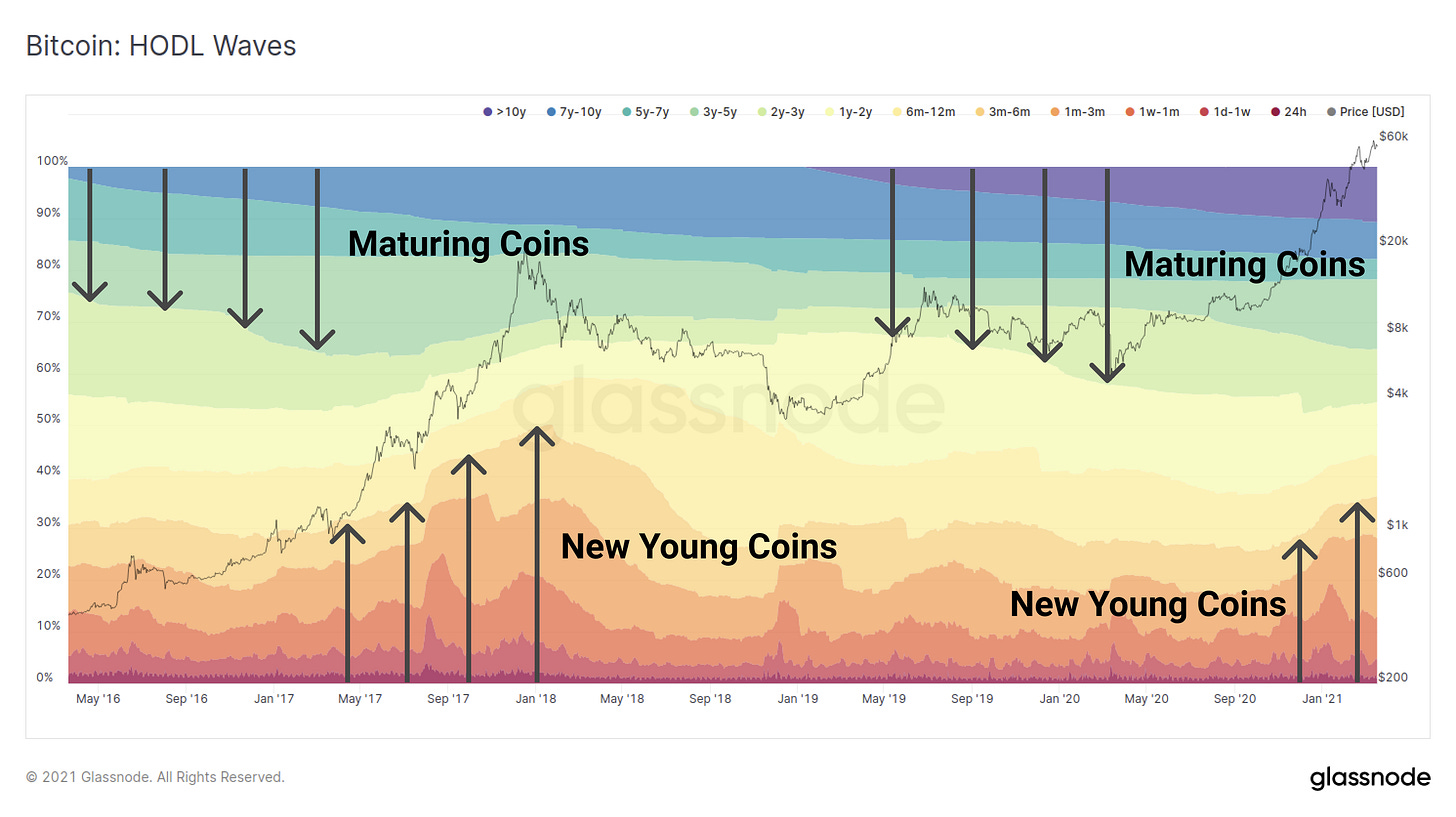

In reality what usually happens, is that the latter buy cycle bottoms with conviction, whilst Bitch Handed Bob FOMO’s in midway up the cycle, and Levers TF Up at the pico-top. This phenomenon is visible in Hodl Waves, which are nothing more than a stacked heat map showing how many coins have moved in certain look-back periods.

The premise is that the longer a coin hasn’t moved, the less likely that it’ll be sent to an exchange to be sold. Therefore, BTC that hasn’t moved in 10+ years is probably lost, out of circulation (and considered “cold”), whilst BTC moved in the last 24hrs is considered “hot” and very likely to be panic sold. The intervals between these two extremes are bunched into cohorts, and we can then create a stacked chart to see what percentage of the total supply is hot, cold, or somewhere in between. The bands are then shaded, as most CT traders are at the colouring-by-numbers phase of intellectual development. So we got to make it easy for them.

When a coin is moved, it joins the 24Hr cohort, following which it matures up the cohorts until it’s moved again. E.g.

T=0: Coin is moved and is in the 24H cohort (hot red)

T+1 Day: Coin is now in the 1D-1W cohort, (light red)

T+2 Months: Coin is now in the 1M-3M cohort (dark orange)

Coin is moved: Coin back to the 24H cohort (hot red)

…

On-chain analysts use this Hodl Wave to determine whether traders are accumulating or distributing assets. This provides context as to the stage of the market cycle, as well as its participant’s broad outlook. If they keep stacking, they assume Number Go Up, if they’re moving cold BTC to exchanges, they’re anticipating distribution, a top, and lower prices at some point in the nearish future.

Additionally, since the ledger is public, it’s possible for us to group wallets into cohorts based on behaviour (tendency to hodl through drawdowns, size of holdings etc). This provides us with insight into what long term investors are doing (the smart money, who go all in at cycle lows, and rarely sell), how whales are trading (they tend to stack at the lows, while retail plebs are shitting the bed and capitulating, and begin to take profit on the way up, with increasing aggression as the same plebs FOMO back in on leverage).

Hodl Wave Classification

Lost/ancient coins (purple/blueish cold colours): These are assumed to be lost, out of supply, and very rarely move. Over an infinite time horizon 100% of supply will end up here.

Old coins (greenish, cool colours): These are coins that haven’t moved in between 1 and 5 years. They generally belong to long term hodlers, cyclical investors, and the smart money that eats your lunch. These guys accumulate heavily in bear markets, and stash their BTC away until retail begin to bid prices up parabolically, at which time they dump on them. These bands tend to fluctuate in thickness (thicc when accumulating, thin when distributing), and are a proxy for the cycle stage the market is in.

Young coins (warm/hot colours): This BTC is generally younger than 6 months, and is the supply used for day to day transactions such as murder for hire, drug dealing, funding of terrorism/North Korea’s nukes, and other day to day activities Elisabeth Warren’s typical Shadowy Super Coder gets up to. These coins are highly liquid supply, and move around a lot. The thickness of their bands fluctuates in an opposing manner to the old coins (they thicken as old coins are spent, and narrow as Smart Money buys them on the cheap and stash them away).

It’s important to bear in mind that there is a time delay at play here. i.e. it’ll take 12-24 months for coins to mature from hot to coolish. But the move back to cold is instant.

Now take another look at the hodl wave below and compare it with the price overlay. It should be clear that as price rises, the hot bands thicken as those dastardly whales distribute their BTC on unsuspecting retail traders. On the flip side, it’s clear to see that as retail run out of second mortgages and kidneys to buy the dip with, the smart money comes in and scoops up the hot BTC (bands thin out) and squirrel it away in cold storage (dark bands start to thicken) for the next rally.

Wrapping up

And there you have it, these are the core building blocks upon which on-chain analysis is constructed. All the fancy, complex sounding metrics such as NUPL/MVRV and RHODL are simply varying perspectives of the same data.

In the next instalment we’ll cover market cap metrics, which will provide you with the zoomed-out macro vision superpower that’ll tell you whether the market is over/under valued, or whether it’s in the Goldilocks Zone.

Have a great week

TCP

Very much appreciate your writing, ser. Thank you!